ARE YOU READY TO BUY YOUR FIRST HOME?

June 23, 2021

By Laurie Fahey

Laurie Fahey

ARE YOU READY TO BUY YOUR FIRST HOME?

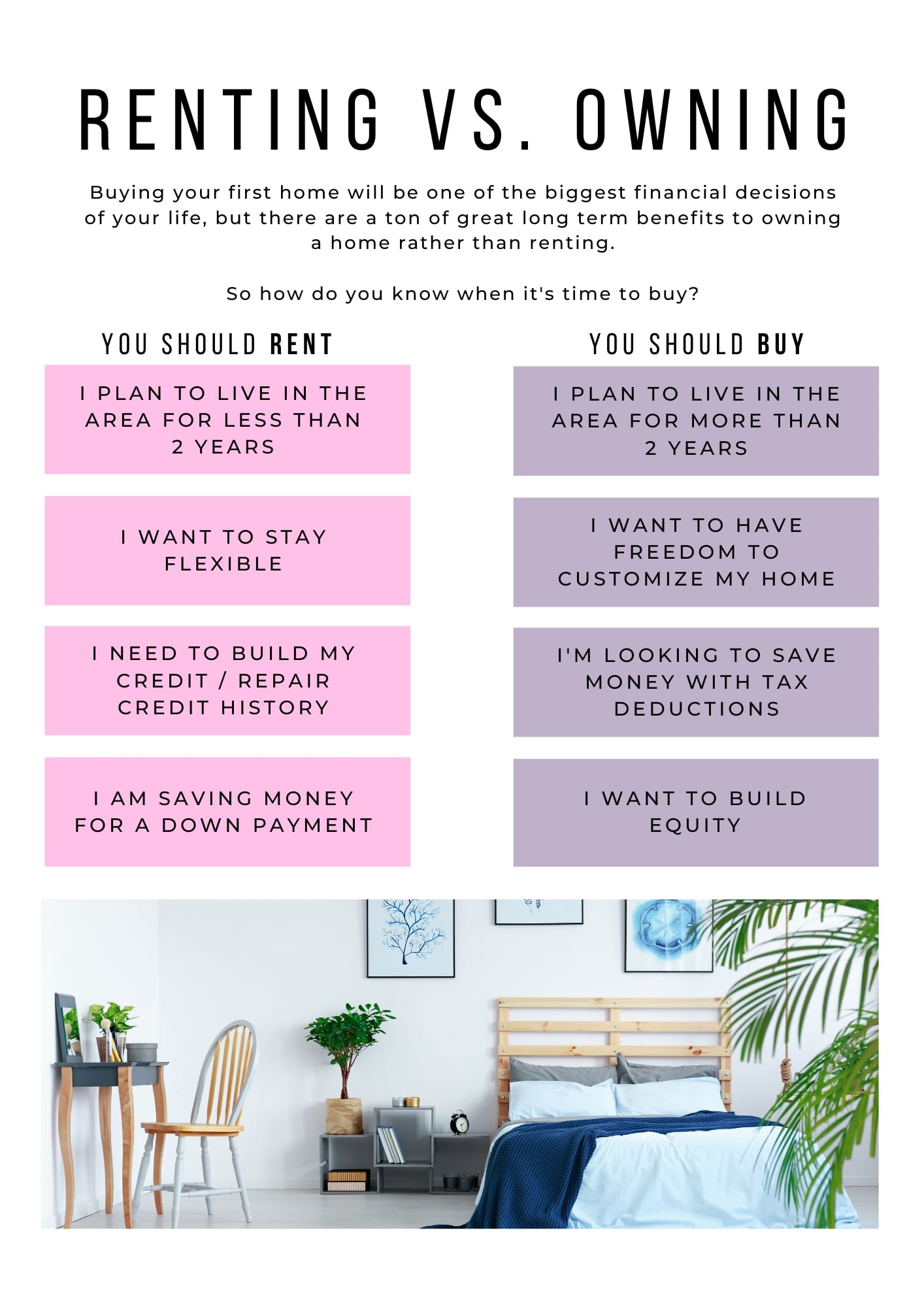

Tired of the rent race and thinking about buying? Buying a home is, yes, a huge financial decision, but it’s also an emotional one. And while you can find online calculators and quizzes galore to tell you whether you’re financially set, the emotional side of buying a home is often overlooked. To gauge if you’re ready—heart, mind, and means—to stop renting and buy, think about these below-the-surface questions:

- Is there a “want to” to buy a home?

You should never buy a home because others are doing it or because you think it’s what you’re supposed to do next. You’ve got to have your own “want-to” and desire.

- Are you ready to put down roots?

Buying is a more long-term decision than renting, so you want to be sure you’re ready to plant for at least a couple of years before signing on the dotted line.

- Do you desire more privacy at home?

If you’re exhausted by noisy neighbors and no place to stretch your legs, it may be time to buy.

- Are you content in your current job?

Lenders want to see job stability, so if you’re thinking of buying, evaluate your long-term employment plans.

- Is your debt-to-income ratio in a healthy place?

Your DTI ratio is an important factor when applying for a mortgage. Getting debt under control before purchasing is always a wise decision.

Here are a few super practical questions to also ask yourself when evaluating your ability and timing for your first home purchase.

- Is your lease or current housing situation ending soon?

- Do you have some savings built up for a down payment?

- Is your credit score good?

- Is your employment situation stable?

- Do you plan to stay in the same area for at least 2 years?

- Are you tired of throwing away money on rent and ready to start building equity in your investment?

If your answers were yes then you are ready to jump head first into the home buying process.

The very first step in the road to homeownership is to contact me!

I specialize in helping First Time Home Buyers get out of the renting trap and get started building equity in their home investment.

The next step will be getting pre-approved for a mortgage loan. Give me a call today and I’ll help you find a great mortgage lender to review your financial information and determine what amount you will be able to borrow.

The next step will be getting pre-approved for a mortgage loan. Give me a call today and I’ll help you find a great mortgage lender to review your financial information and determine what amount you will be able to borrow.

M&M NEWS

Related Articles

The Real Estate Market is Cyclical, Don’t Panic, Adjust!

The Real Estate Market is Cyclical, Don’t Panic, Adjust! The Real Estate market is cyclical. The data shows, and it’s clear that we are experiencing one of the toughest real estate markets in the past decade. As bad as it is, there are certain agents who do well,...

Why the housing market is going from tough to terrible

Why the housing market is going from tough to terrible Do you like this Article ? Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article. M&M Membership includes: FREE Coaching Events & Workshops,...

As mortgage rates hit 8%, home ‘affordability is incredibly difficult,’ economist says

As mortgage rates hit 8%, home ‘affordability is incredibly difficult,’ economist says Do you like this Article ? Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article. M&M Membership includes: FREE...