So Cal Re Market Report/ Buyer, Seller & Investor Tips

So Cal Re Market Report/ Buyer, Seller & Investor Tips

Do you like this Article ?

Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article.

M&M Membership includes: FREE Coaching Events & Workshops, access to our Real Estate News Group (Local & National Real Estate and Financial News), access to social media marketing tips and nuggets, So Cal weekly market report, and much more.

So Cal Market Beat

Buyer, Seller & Investor Tips

MAI: Market Action Index. MAI of 30 represents a balanced market between buyers and sellers. Over 30 indicates a seller market and below 30 is a buyer market.

Avg. DOM: Average days on the market.

Source Altos.re

Buyers, Sellers & Investors: Seek the advice of an experienced local realtor for data specific to your market. Work with realtors with skills and character you can trust, find them on our Real Estate Expert Panel on our home page.

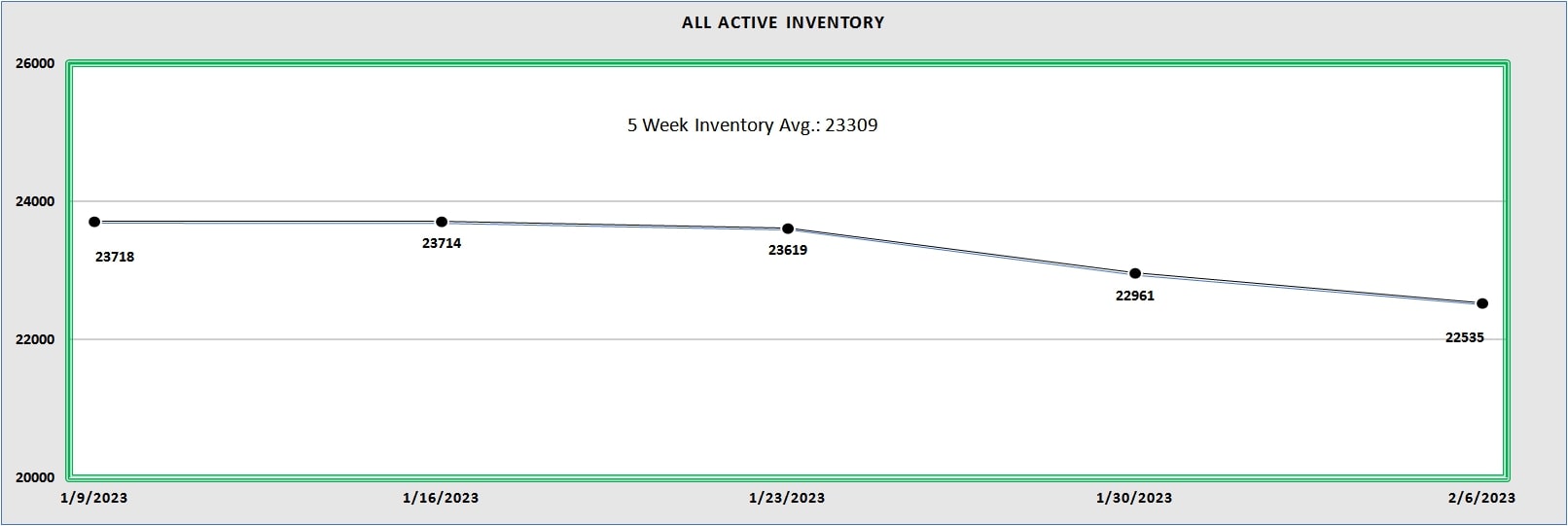

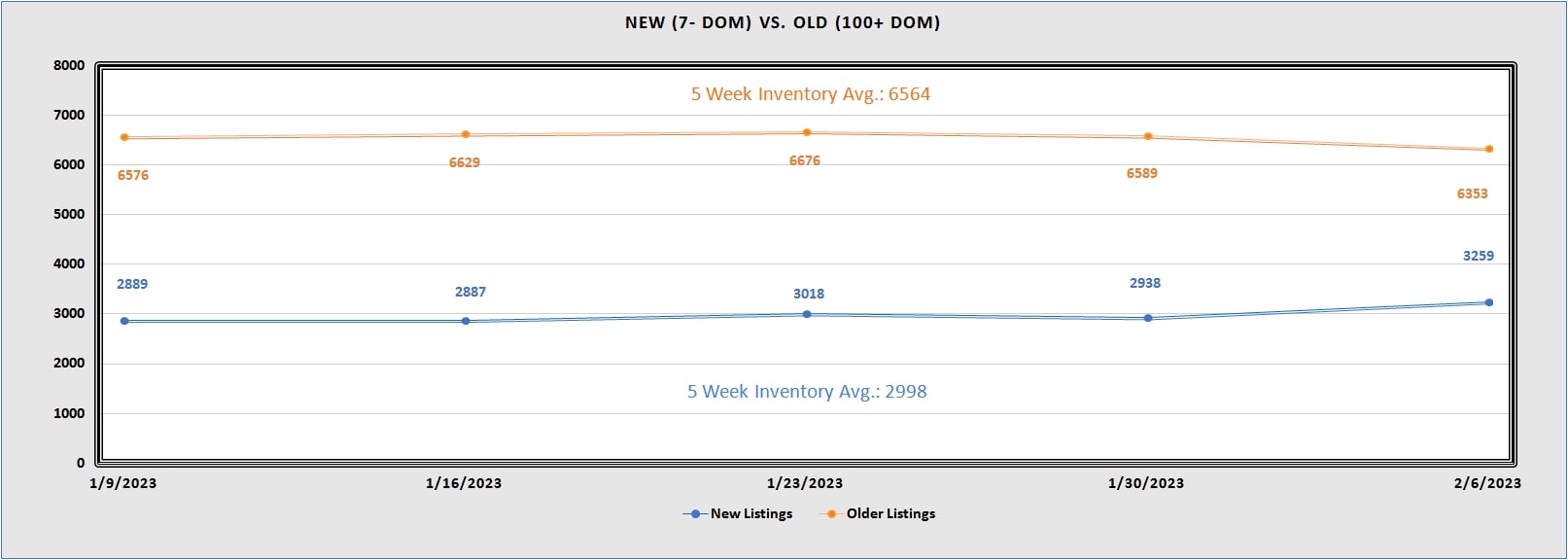

5 Week Trends

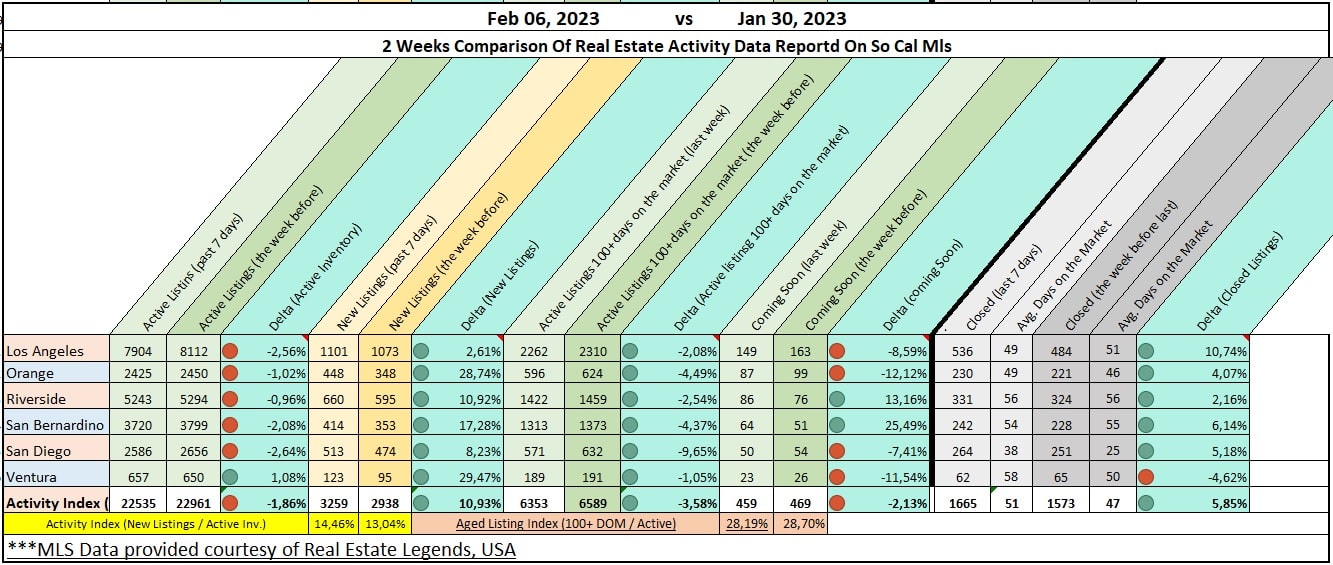

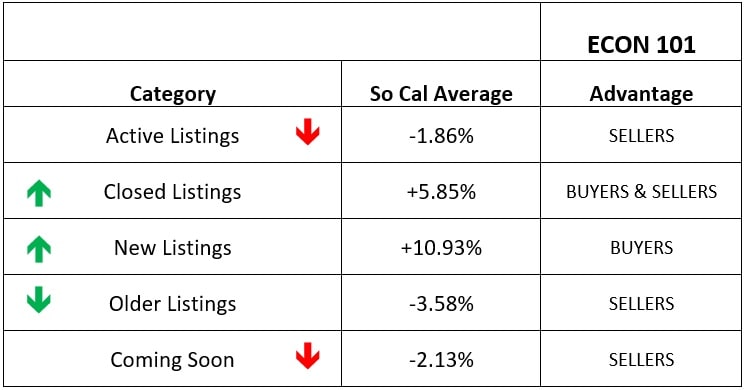

In So Cal, there was overall downward trend in inventory with average decrease of 1.86%. The exception was Ventura County with increase of 1.08%.

New listings in the region showed upward trend with an average increase of 10.93%. There were no exceptions in the region.

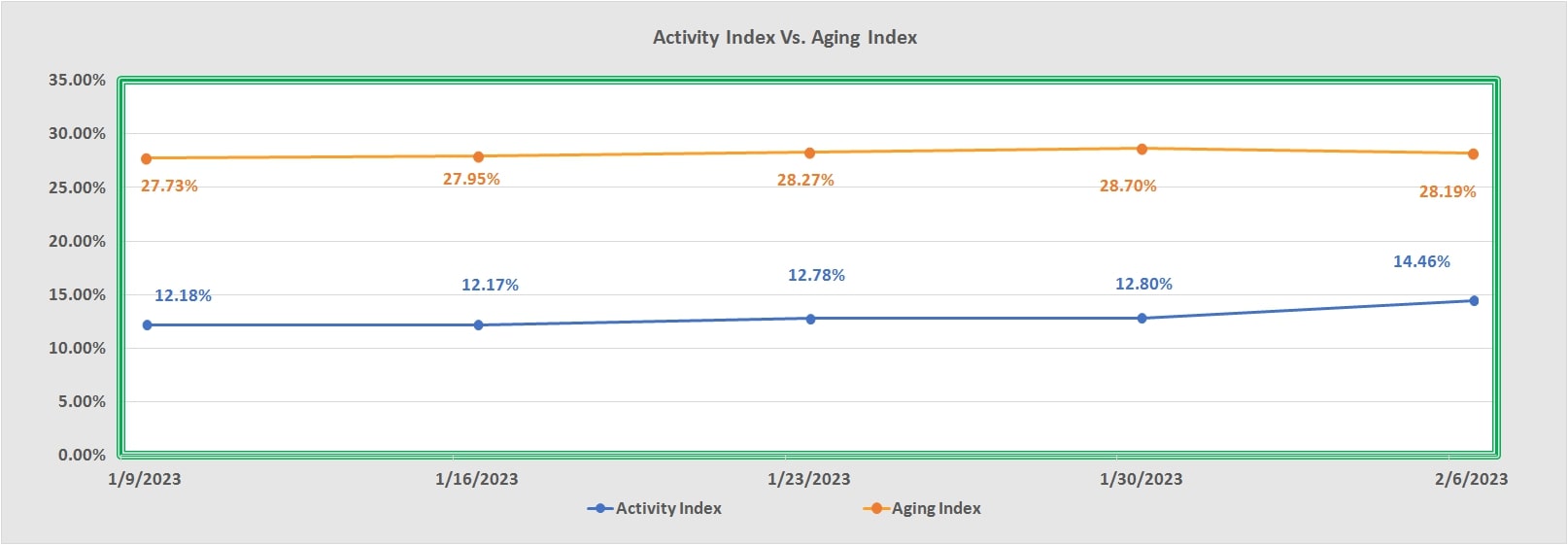

New listings were 14.46% of total active inventory and older listings were at 28.19% of the active listings.

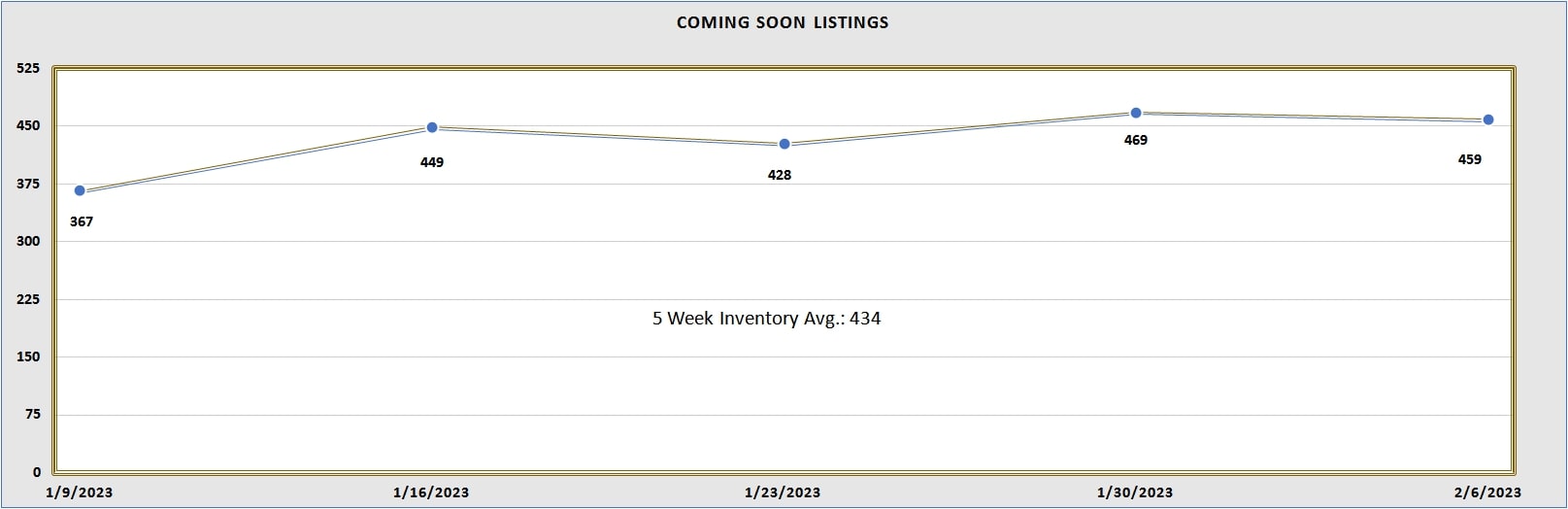

Coming soon inventory changed the trend from last week and went down by 2.13%.

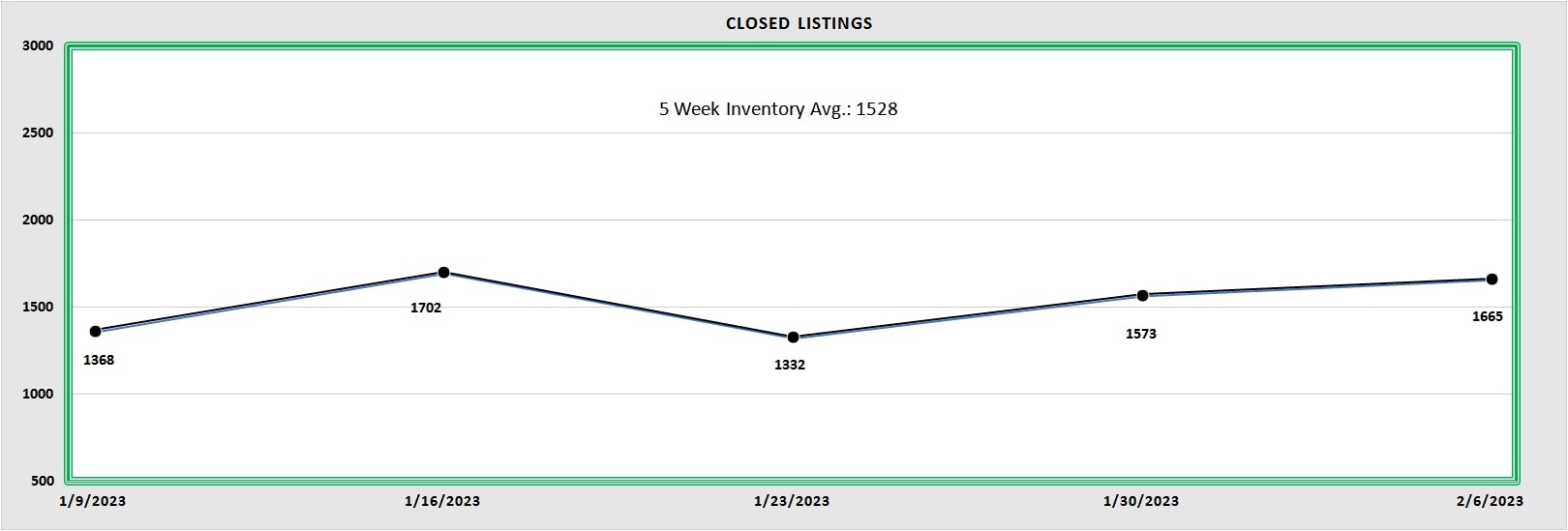

Closed listings continued the trend from last week and went up by an average of 5.85% in So Cal.

For data specific to your local market, we have expert real estate professionals listed on M&M Expert Panel under the real estate column. Additional real estate services maybe found in M&M Business Directory. For free real estate and mortgage consulting, write to [email protected].

M&M NEWS

Related Articles

The Real Estate Market is Cyclical, Don’t Panic, Adjust!

The Real Estate Market is Cyclical, Don’t Panic, Adjust! The Real Estate market is cyclical. The data shows, and it’s clear that we are experiencing one of the toughest real estate markets in the past decade. As bad as it is, there are certain agents who do well,...

Why the housing market is going from tough to terrible

Why the housing market is going from tough to terrible Do you like this Article ? Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article. M&M Membership includes: FREE Coaching Events & Workshops,...

As mortgage rates hit 8%, home ‘affordability is incredibly difficult,’ economist says

As mortgage rates hit 8%, home ‘affordability is incredibly difficult,’ economist says Do you like this Article ? Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article. M&M Membership includes: FREE...