The Strange Game Of Chicken Happening Between Homebuyers And Sellers: Who Will Blink First?

The Strange Game Of Chicken Happening Between Homebuyers And Sellers: Who Will Blink First?

Do you like this Article ?

Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article.

M&M Membership includes: FREE Coaching Events & Workshops, access to our Real Estate News Group (Local & National Real Estate and Financial News), access to social media marketing tips and nuggets, So Cal weekly market report, and much more.

The Strange Game Of Chicken Happening Between Homebuyers And Sellers: Who Will Blink First?

The real estate game is at a stalemate that shows no signs of budging anytime soon, with neither buyers nor sellers willing to make the first move.

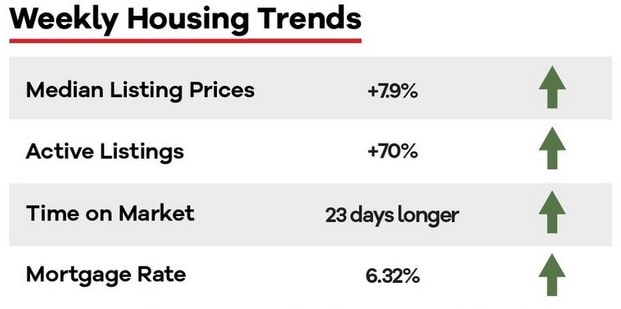

Buyers have little incentive to lead the way. According to Freddie Mac, they’re battling high home prices and climbing mortgage rates, which rose to 6.32% for a 30-year fixed-rate mortgage in the week ending Feb. 16.

Meanwhile, home sellers—who, a mere year earlier, enjoyed packed open houses and bidding wars—are now battling to stand out from hordes of other sellers, as the pool of available homes soared 70% higher for the week ending Feb. 11 compared with the same period last year.

“The market’s abrupt adjustments over the last year have made it harder for all participants to determine their own boundaries, let alone figure out how to meet in the middle so that a transaction can take place,” says Realtor.com® Chief Economist Danielle Hale in her analysis of housing data for the week ending Feb.11.

But amid the backdrop of soaring inventory and still-high home prices, another data point suggests some sellers might be finally willing to change up their strategy.

“January data shows that the share of home sellers making a price reduction was more than twice as large as one year ago,” notes Hale. Indeed, 15.3% of sellers in January slashed their prices compared with 6% a year earlier.

We will analyze the latest real estate statistics and explain what it means for homebuyers and sellers in this latest installment of “How’s the Housing Market This Week?”

Why price cuts don’t necessarily mean bargains

Despite these price cuts, listing prices are still high. In January, they clocked in at a median of $400,000, and they increased by 7.9% for the week ending Feb. 11 compared with that same week a year earlier.

Plus, mortgage rates remain roughly 2.5 percentage points higher than last year.

This one-two punch of high home prices and mortgage rates has sapped buyer motivation, adding to the current real estate standstill.

“High home prices and mortgage rates have required budget contortions from buyers,” explains Hale.

Some house hunters have just given up, letting listings grow stale. For the week ending Feb. 11, homes lingered on the market 23 days longer than they did this same week a year earlier. That’s the 29th week in a row that sales have grown more sluggish.

Indeed, Hale notes the days a typical property spent on the market in 2023 compared with 2022 has “grown sharply in recent weeks.”

Meanwhile, the dearth of sellers listing new homes continued its 32-week run, with 13% fewer homeowners listing their homes for the week ending Feb. 11 compared with this week last year.

How buyers and sellers should change their strategies

So how do both buyers and sellers work together to get the market moving again?

“Both groups will need to adjust their expectations and be aware of the slower market pace,” says Hale.

Cash-strapped buyers do have an abundance of one thing in the real estate game: negotiating power. Those who seize this advantage could, rather than simply ignoring the market, leverage this dynamic to snag a lower home price to offset high mortgage rates.

Meanwhile, home sellers should size up the glut of homes on the market and, rather than price high and trim that number later, price their homes affordably right as they hit the multiple listing service—and catch a buyer’s eye from the get-go when their listing is fresh and in demand.

Hale also notes that today’s near comatose, tamped-down market isn’t necessarily a bad thing.

“This slower market pace is a return to what was normal before the [COVID-19] pandemic,” Hale says. “And buyers and sellers will need to keep this in mind when entering the housing market this spring.”

Source: www.realtor.com

Author: Margaret Heidenry

Mortgage Rates Are Below 6 Percent

Mortgage rates peaked 12 weeks ago. They’re much lower now.

According to Freddie Mac, February 2023 begins with the average 30-year, fixed-rate conventional mortgage rate at 6.13 percent.

For many first-time buyers, the rate is even lower.

In December, the government introduced new rules to reduce mortgage rates for low- and moderate-income home buyers. Then, in mid-January, it introduced a second set of rules to lower interest rates on low-down payment mortgages for everyone.

Market forces are also improving rates.

Consumer costs dropped in most economic sectors last month, so the Federal Reserve is less likely to raise borrowing costs. Inflation and

As mortgage rates go down, purchasing power goes up.

For the same mortgage payment, February home buyers can buy 15 percent more home as compared to three months ago, and analysts expect rates to drop again over the next 60 days. Wall Street believes that the Federal Reserve stopped economic inflation and engineered a soft landing for the U.S. economy.

When inflation pressures retreat, so do mortgage rates.

Home Values Aren’t Headed For A Crash

The U.S. housing market isn’t headed for a crash, and data suggests that a market bottom is already here.

According to real estate data company Altos Research, February 2023 begins with just 466,000 single-family homes for sale, marking the tightest home inventory since last June.

Altos Research also reports an uptick in home sales.

February begins with 264,000 homes under contract to sell, representing a 12 percent jump from the New Year. And according to the National Association of REALTORS®, more than half of homes sold sold within a month.

Home buyer activity is up sharply this year, too.

Homebuyer.com data shows a 73.9 percent jump in mortgage applications in January compared to the prior month, and search traffic for first-time home buyer queries such as “first-time home buyer grants” and “what credit score do you need to buy a house” doubled in the same period.

At the current pace of home sales, NAR reports, buyers would buy up every U.S. home listed for sale before the start of June.

Data points like these are the hallmarks of healthy, expanding markets.

Sellers Are “Throwing Money” At Buyers Right Now

A third reason why February 2023 is a good time to buy a home, to borrow a phrase from Axios, is “sellers are throwing money at buyers right now.”

A sample of real estate contracts shows 42% of home sellers gave concessions to buyers recently, including money for home repairs, closing costs, and mortgage rate buydowns. Another one-third of sellers lowered their home’s sale price to make their homes more attractive to buyers.

Today’s home sellers behave like they’ve lost their leverage over buyers. The data suggests they haven’t.

For buyers, the current housing climate represents opportunity. Buyers can make demands, and those demands get met by sellers. Between now and late March, buyers will retain this advantage and can buy terrific homes at lower, more affordable prices.

Mortgage Rate Discounts For First-Time Buyers

Effective immediately, eligible first-time buyers get automatic mortgage rate discounts on their conventional mortgage loans.

Through the FHFA First-Time Home Buyer Mortgage Rate Discount, low- and moderate-income first-time buyers can purchase a primary home, finance it with a conventional fixed-rate or adjustable-rate mortgage, and get a discounted mortgage rate.

The FHFA First-Time Home Buyer Mortgage Rate Discount changes the math of “Should I rent or buy a home?”

The money-saving program is valid for single-family homes, condos, townhomes, and multi-unit properties. Qualified buyers automatically get mortgage rate discounts of up to 1.75 percentage points off their mortgage rate, with no additional documentation.

The discount program is temporary, another reason why February 2023 is a good time to buy a home. Once the program’s gone, mortgage rates go up.

Click here to check your discount eligibility.

Buying A Home With A Small Down Payment

For many first-time home buyers, when it’s time to buy a home, it’s time to buy a home – it doesn’t matter whether current interest rates are too high, available home supplies are too low, or there’s enough money saved up in the bank.

Homeownership can’t always wait.

Thankfully, first-time buyers can achieve their American Dream of homeownership without having 20 percent saved for a down payment.

Buyers can use several government-backed low down payment mortgages and down payment assistance programs available to eligible buyers.

Plus, it’s getting easier to get a mortgage approved.

Lenders have lowered minimum credit score requirements for certain low- and zero-down loans and Congress also is stepping in to assist.

Nine homeownership and affordable housing bills are working through Congress to give first-time buyers programs tax credits, cash grants, and other purchase incentives. Watch this video for a review of the programs.

Buying A Home Into The 2023 Housing Market

February 2023 is a good time to buy your first home. Mortgage rates are down, home prices are settled, and buyers have leverage over sellers.

Our advice for today’s home buyers:

First, do your mortgage pre-approval. Mortgage pre-approvals use today’s mortgage rates to tell you how much home you can afford and set realistic boundaries for your home search.

Every successful purchase starts with a good pre-approval. It’s never too early to get one.

Second, do work on your credit score. Review your credit report for errors and supplement your monthly bill-paying with a credit-building service such as StellarFi that can work in as few as 30 days.

Third, research down payment assistance programs in your area via the HUD website. Some programs may have been discontinued or defunded in the new year, so call the local provider to verify availability.

Source: www.homebuyer.com

Author: Dan Green

M&M NEWS

Related Articles

The Real Estate Market is Cyclical, Don’t Panic, Adjust!

The Real Estate Market is Cyclical, Don’t Panic, Adjust! The Real Estate market is cyclical. The data shows, and it’s clear that we are experiencing one of the toughest real estate markets in the past decade. As bad as it is, there are certain agents who do well,...

Why the housing market is going from tough to terrible

Why the housing market is going from tough to terrible Do you like this Article ? Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article. M&M Membership includes: FREE Coaching Events & Workshops,...

As mortgage rates hit 8%, home ‘affordability is incredibly difficult,’ economist says

As mortgage rates hit 8%, home ‘affordability is incredibly difficult,’ economist says Do you like this Article ? Sign up HERE for your FREE M&M Account to receive more Real Estate related information and news and THIS article. M&M Membership includes: FREE...